Property Tax Deductions

Deduction Eligibility:

You may be eligible for a tax deduction off of your tax bill. The State of NJ offers two deductions at the local level; one for seniors/disabled person/surviving spouse and one for veteran/widow of veterans. Each deduction reduces taxes by $250.00 per year. There is also an exemption for disabled veterans; where the disability was caused by their service in the Armed Forces. Kindly contact the Tax Assessor at (973) 403-6028 for more information.

Property Tax Relief Programs:

All property tax relief program information provided here is based on current law and is subject to change. Read more here.

State of New Jersey ANCHOR Program:

The State's new ANCHOR program replaces the previous Homestead Benefit program to provide property tax relief to eligible homeowners and also renters. The Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) provides property tax relief to New Jersey residents who owned or rented their principal residence (main home) before a set date and has met the income limits. Read more about the program here.

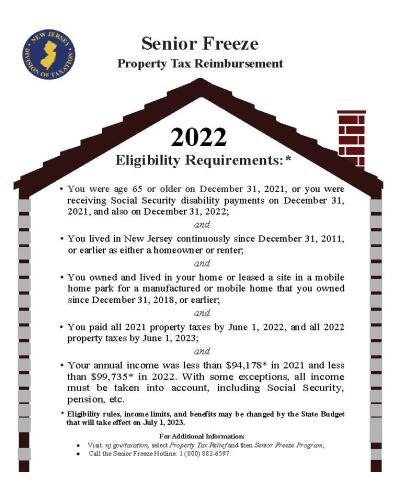

Property Tax Reimbursement Program aka "Senior Freeze":

The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence. To qualify, you must meet all the eligibility requirements for each year from the base year through the application year. Read more here.

The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence. To qualify, you must meet all the eligibility requirements for each year from the base year through the application year. Read more here.

Contact Information:

- To ask questions, please call 1-800-882-6597 from 8:30 a.m. to 4:00 p.m., Monday through Friday, except holidays.

- To listen to information or to order an application, please call 1-800-323-4400.

- In-person assistance is available at Taxation Regional Offices from 9 a.m. to 4 p.m., Monday through Friday, except holidays. To make an appointment, please use the online scheduling portal.

- Online information is available on the Division of Taxation Website.

- Text Telephone Service (TTY/TDD) for Hard-of Hearing Users is available at 1-800-286-6613 or 609-984-7300.

- For general questions, you may Email or complete the Webform to contact the NJ Division of Taxation online.